Discover how a 1035 exchange can optimize your financial portfolio and potentially save you money on taxes.

Understanding the Basics of a 1035 Exchange

A 1035 exchange, named after Section 1035 of the Internal Revenue Code, allows policyholders to swap an existing life insurance policy, endowment policy, or annuity contract for a new one without incurring immediate tax liability. This is a strategic move that can help you optimize your financial portfolio by upgrading to a policy that better suits your current needs.

The primary advantage of a 1035 exchange is that it allows you to maintain the tax-deferred status of your investment. Essentially, you are deferring any capital gains or income taxes that would otherwise be due upon the liquidation of the old policy.

Benefits of a 1035 Exchange for Your Financial Plan

One of the most significant benefits of a 1035 exchange is the ability to replace an under-performing or outdated policy with one that offers better benefits, lower fees, or more favorable terms. This can be particularly advantageous if your financial goals or personal circumstances have changed since you first purchased the original policy.

Another benefit is the potential for improved investment options and flexibility. Many modern policies come with enhanced features, such as indexed or variable investment options, which can provide greater growth potential and adaptability to market conditions.

Eligibility Criteria for a 1035 Exchange

To be eligible for a 1035 exchange, the policies involved must meet certain criteria. The exchange must be between like-kind policies: a life insurance policy for another life insurance policy, an endowment policy for another endowment policy, or an annuity contract for another annuity contract. Additionally, the owner and the insured or annuitant must remain the same during the exchange process.

It is also important to note that partial exchanges are allowed under specific conditions, which can offer more flexibility in managing your financial portfolio. However, not all policies or contracts qualify for a 1035 exchange, so it is crucial to consult with a financial advisor to determine your eligibility.

Step-by-Step Guide to Executing a 1035 Exchange

Executing a 1035 exchange involves several steps. First, evaluate your current policy and identify your reasons for considering an exchange. Determine if a new policy will better meet your financial goals and needs.

Next, consult with a financial advisor to review your options and ensure that the new policy qualifies for a 1035 exchange. Your advisor can help you compare different policies and choose the best one for your situation.

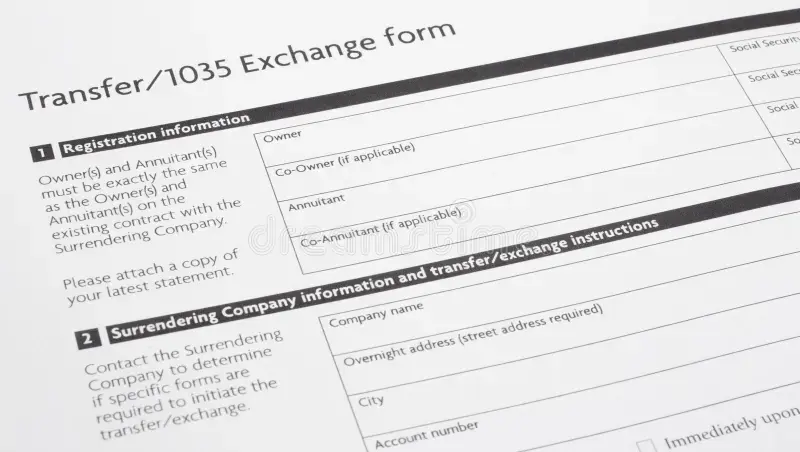

Once you have selected the new policy, complete the necessary forms and paperwork for the 1035 exchange. This typically involves submitting an application for the new policy and a 1035 exchange form to your current and new insurance providers.

Finally, monitor the process to ensure that the exchange is completed correctly and that all details are accurately transferred to the new policy. Keep thorough records of the transaction for your financial and tax records.

Common Mistakes to Avoid During a 1035 Exchange

One common mistake to avoid during a 1035 exchange is not thoroughly comparing the new policy with your existing one. Ensure that the new policy offers better benefits and terms that align with your current financial goals.

Another mistake is failing to understand the fees and costs associated with the new policy. Some policies may have hidden fees or surrender charges that can negate the benefits of the exchange. Always read the fine print and consult with your financial advisor to avoid unexpected expenses.

Lastly, ensure that you complete all necessary paperwork accurately and submit it in a timely manner. Errors or delays in the process can lead to complications or disqualification of the exchange, leading to potential tax liabilities.