Choosing between a Traditional IRA and a Roth IRA can significantly impact your financial future. Discover the key differences and make an informed decision for your retirement planning.

Understanding the Basics: What is an IRA?

An Individual Retirement Account (IRA) is a type of savings account specifically designed for retirement. It offers tax advantages that encourage people to save for their future. There are two main types of IRAs: Traditional and Roth.

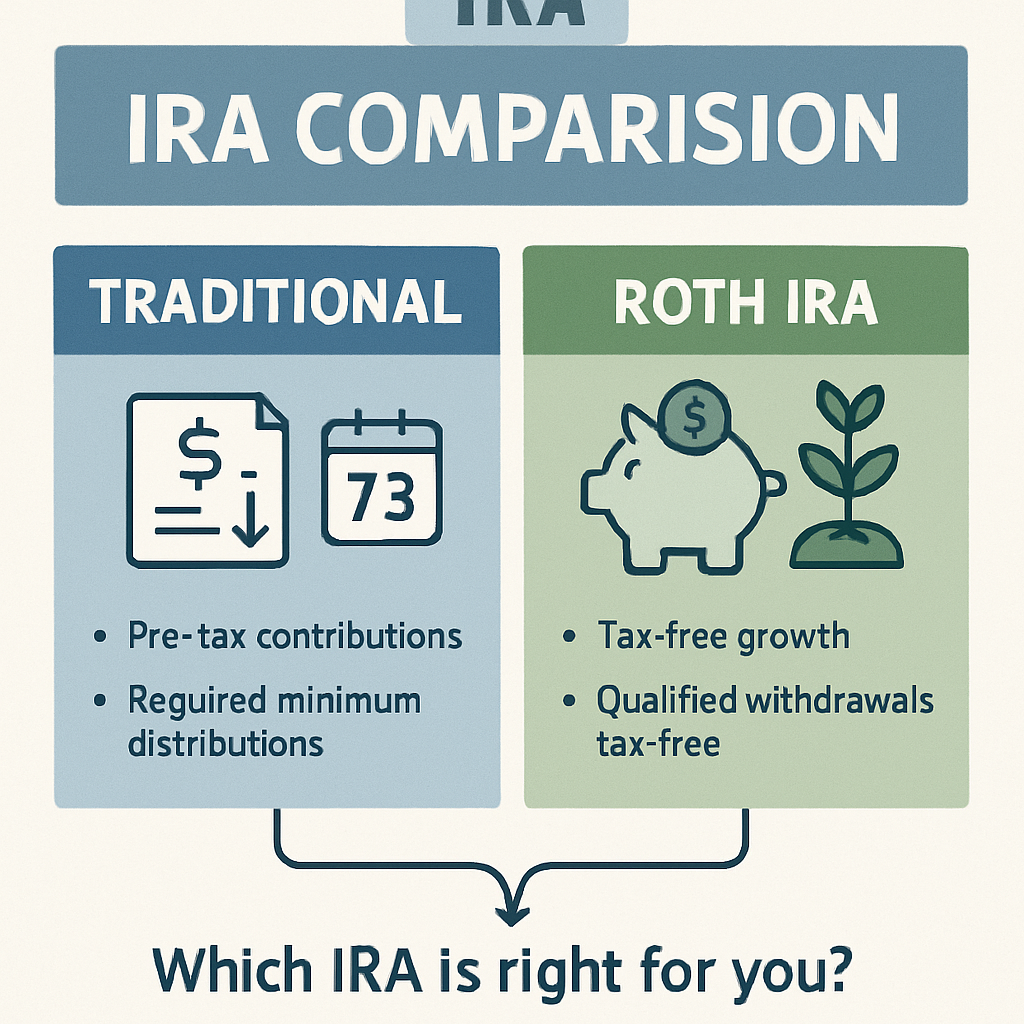

A Traditional IRA allows you to make pre-tax contributions, which can reduce your taxable income in the year you contribute. On the other hand, a Roth IRA involves post-tax contributions, meaning you pay taxes upfront but can enjoy tax-free withdrawals in retirement.

Tax Treatment: Pay Now or Pay Later?

The primary difference between Traditional and Roth IRAs lies in their tax treatment. With a Traditional IRA, you get immediate tax benefits because your contributions are tax-deductible. However, you will pay taxes on your withdrawals in retirement.

Roth IRAs take the opposite approach. You pay taxes on your contributions now, but your money grows tax-free, and withdrawals in retirement are also tax-free. This can be particularly beneficial if you expect to be in a higher tax bracket in retirement.

Contribution Limits and Eligibility Criteria

For both Traditional and Roth IRAs, the contribution limit for 2025 is $7,000 per year, or $8,000 if you're 50 or older. However, eligibility for Roth IRAs is subject to income limits. In 2025, single filers with a modified adjusted gross income (MAGI) of $146,000 or more are subject to contribution phase-outs, with a complete phase-out at $161,000.

Traditional IRAs do not have income limits for contributions, but the tax deductibility of contributions may be limited if you or your spouse are covered by a retirement plan at work and your income exceeds certain levels.

Withdrawal Rules: Accessing Your Money

Withdrawal rules also differ significantly between the two types of IRAs. With a Traditional IRA, you are required to start taking required minimum distributions (RMDs) starting at age 73. These distributions are subject to ordinary income tax.

Roth IRAs, however, do not have RMDs during the account holder's lifetime, offering more flexibility. Additionally, qualified withdrawals from a Roth IRA are tax-free, provided the account has been open for at least five years and the account holder is at least 59½ years old.

Which IRA is Right for You?

Choosing the right IRA depends on your current financial situation and your expectations for the future. If you anticipate being in a lower tax bracket in retirement, a Traditional IRA might make more sense due to the immediate tax benefits.

Conversely, if you expect to be in a higher tax bracket in retirement or prefer the flexibility of tax-free withdrawals, a Roth IRA could be the better option. Evaluating your long-term financial goals and consulting with a financial advisor can help you make an informed decision.